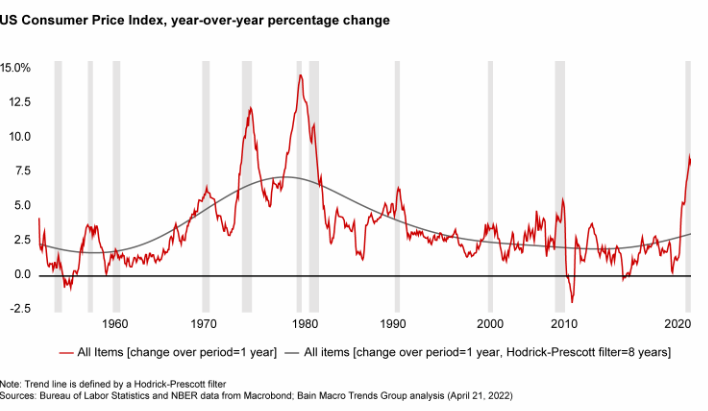

The tide is changing. Asset classes that have been teeming with possibilities for the past 18 months are at least in part underwater in a sea of escalating interest rates, stock market volatility, and 9.1% inflation (U.S. Inflation Calculator, 2022).

(Source: U.S. Inflation Calculator, 2022)

Companies can’t evade the rising tide. Interest rates require a boost to combat inflation’s swelling crest, but central banks must carefully navigate this contractionary economic response to avoid triggering a recession. We can all see the whitecaps. Capital is more expensive, making debt refinancing a luxury hindered by the scrutiny of tighter diligence. Spikes in commodity prices and ongoing supply shortages exacerbate the issue, inflating costs and consumer price sensitivity while diminishing cash flow and reserves. And historically, according to a Bain Macro Trends Group analysis, such inflation events in the U.S. tend to last about 30 months (Bain, 2022a).

Dashboards Provide Essential Visibility

What can mid-market leaders do to stay afloat in the uncertainty? How can they not just “make it,” but thrive during inflationary high waters? Economies are cyclical, and those who resist battening down the hatches take advantage of the ebbs as the greatest opportunity to distance themselves from the regatta (and position themselves to circumnavigate when headwinds recede).

According to Bain & Co., leaders should control what they can. In the same 2022 mid-year private equity report, Bain advises that, “Successfully negotiating the current environment will require controlling what you can as an investor. It will be essential to help management wring out revenue gains, preserve (and even expand) margins, and manage cash on the balance sheet” (Bain, 2022a). In other words, success during uncertainty is about maintaining control. That makes sense. But to that formula, we’d offer a key term of use – visibility is required for control.

Calm (non-reactionary) management relies on visibility. You can’t control what you can’t see.

Pilots can’t navigate a storm without instruments, and F1 drivers can’t lead the field without a dashboard. Well, technically they can, but we would call them reckless, or even insane. They need heads-up access to essential data such as speed, engine temperature, and fuel level. Clarity enables the best decisions, particularly in uncertain or dangerous times.

The same holds for business. Can a business leader navigate effectively without data visibility?

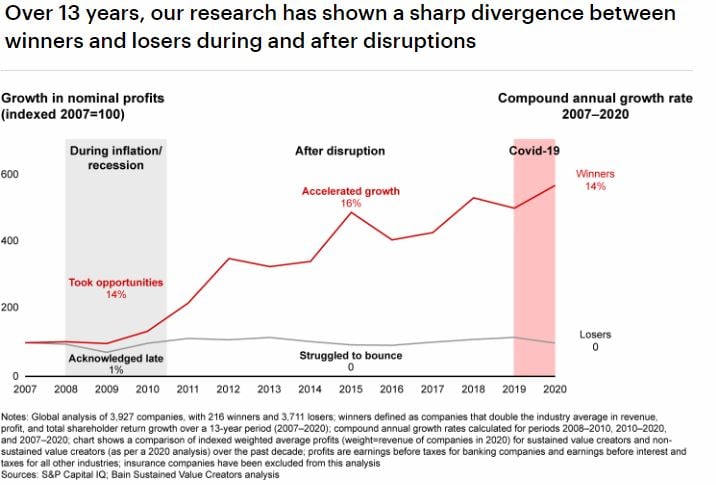

Technically, they could, but they would lack the insights needed to create value, especially when the margin for error is tight. “Top-tier performance moving forward will depend on nuts-and-bolts value creation and a clear understanding of how to manage effectively during a period or rising prices” (Bain, 2022a).

Business intelligence dashboards create tangible value for mid-market executives, giving them control over the levers and leading indicators that most impact revenue, margins, and cash. However, most companies approach data initiatives like an ERP implementation, a waterfall project with lessons learned the hard way, rather than capturing quick wins and improving as they go. Enlisting the help of a expert who understands modern data warehouse and dashboard design that’s agile, easy to use, and gets adopted will sidestep the pitfalls that cause most companies to fall short of becoming data-enabled. Starting with real-time scorecards, such as this commercial services example can untangle points of constraint in a matter of days and quickly transform an organization through increased awareness and shared accountability (in this recent podcast episode, our founders discuss how to make data intelligence the fastest, most effective way to put strategy into action).

Increased Valuation through Dashboard Reporting

Several midmarket clients have shared how they increase company value through data intelligence across various industries. Here are some of their results:

Commercial Services

Smart Care, a PE-backed industrial kitchen commercial service company, notes that, “We shared our dashboards with our district managers. It took our utilization up from 68% to 72% inside of a year without system re-engineering, just by creating visibility and awareness. That amounted to $750,000 per year to the bottom line. A 4% profitability increase.” See case study

Industrials

Equilibrium Catalysts, an industrial chemical company, discovered ~$1 million in unbilled services through their dashboards. Additionally, prior to dashboards, they weren’t able to carefully analyze costs by carrier. With greater visibility, they have recaptured hundreds of thousands of dollars in overhead by strategically switching between carriers.

Manufacturing

Elgin Fastener Group, a PE-backed manufacturer, writes, “The greatest impact has been on the manufacturing side – The Efficiency and Utilization Report. This eliminated a workbook with multiple data sources. We used to generate that report once per month, limiting our ability to react. We do it daily now. Supervisors use that to address training, points of constraint, combining operations, etc. We adjust as we go, making our response much closer to the actual event, which has increased production an estimated 10%.”

Data as a Strategic Investment

Many leaders, particularly those with finance, analytics, or IT backgrounds, are aware of their data deficits. Their organizations may have acquired technical debt through sub-par reports developed in Excel. Many have created Excel “jungles” by filling ad-hoc report requests through an order-taking approach. These leaders may be apprehensive about BI, viewing the prospect of building a data warehouse that supports impactful BI dashboards through a lens from 10, or even 5 years ago. But history is not on the side of the luddites who don’t take advantage of the speed that current tools offer. According to Bain & Co., strategic future-minded investments during recession are often the bellwethers of future growth (Bain, 2022b). Now is the time to overtake those competitors glued to the rear-view mirror.

When the concealed is made visible, uncertainty takes a backseat to cool, calm, controlled execution. Business is largely about visibility – what’s working, what’s not, and what’s coming around the corner. Business intelligence dashboards are the shortest path to regaining control and taking advantage of a downturn.