Carter Freeman, VP at Virtual CFO (vcfo.com), has extensive experience leading and advising companies in both strategic and tactical financial capacities. Before joining VCFO almost 17 years ago, Carter served as CFO for four different companies.

As a consulting firm, VCFO provides advisory services to make companies stronger through finance, human resources, technology, and recruiting support. VCFO began in 1996 and has locations in Austin, Dallas, Denver and Houston.

Carter joined Jon Thompson of Blue Margin in an interview to discuss the evolving role of the CFO and how visibility into financial data is foundational to successfully running a business. Carter shared his thought leadership on some poignant topics relevant to today’s financial leaders, and here are a few highlights:

- CFOs are uniquely positioned to focus the executive team around the central narrative of financial data.

- Companies should expect to outgrow Excel as they mature. Automated dashboards free up time, clearing the way for focus and execution.

- The CFO seat is becoming increasingly strategic, filling that role requires the ability to turn data into a story the organization can attach to.

- “Data is an enabler of growth. It’s a tool.”

Accountants Read Numbers, CFOs Tell the Story

Accountants read numbers like the rest of us read words. They love spreadsheets and data but often struggle to pull relevant signals from the noise in order to tell a compelling narrative that galvanizes the executive team. Financial leaders must be storytellers to successfully persuade senior leadership (and others) to take action on the right priorities.

Carter believes the demarcating factor between an accountant and a CFO “is the ability to look at numbers and use them to illustrate the message you’re trying to get across.” A good resource to advance this skillset is the bestselling book Storytelling with Data, written by Google Analytics leader Cole Nussbaumer Knaflic.

Has Your Organization Outgrown Excel?

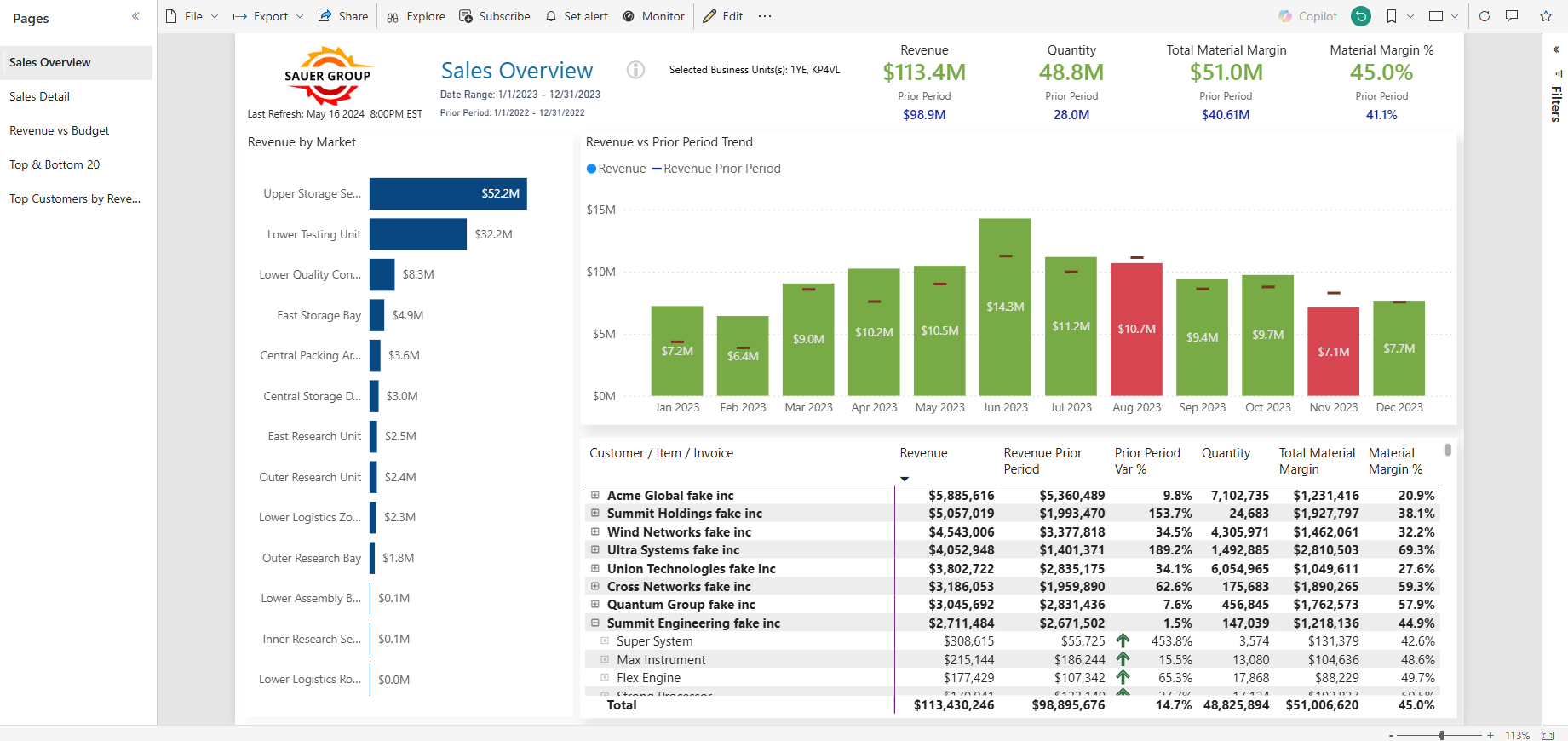

Carter highlights the use of Excel as a bellwether in the evolution of a company. While Excel is an excellent tool, it can be fragile and has other limitations. Bruce Lynn, Partner at financial and treasury consulting firm FECG writes, “I have my spreadsheet, you have your spreadsheet, everybody else has their spreadsheets, and none of them talk to each other.” In contrast to Excel, more powerful storytelling tools like Power BI, Tableau, or Qlik, while advantageous, “take more time, money, expertise,” according to Carter.

So when should a business transition from Excel to a BI tool? Carter explains that as organizations grow and accumulate larger and more complex data, they can quickly cross that line. “I would argue that, for a lot of companies, the lines have probably long since crossed.” Once a business integrates dashboards, the time it took to gather data is now freed to focus on the business. This transition is further explored in the article Moneyball for Business.

Transformation of the CFO to Strategic Leader

PwC’s 2020 CFO survey notes five key trends: digitizing finance and accounting, robotic process automation, real-time analytics, reporting and data visualization, and talent competition. PwC notes, “The democratization of data, business intelligence and data science is eliminating the competitive advantage from analytics and turning it into table-stakes . . . CFOs can use these advanced analytics to determine where to invest, including new markets, channels, partnerships and R&D. In addition, CFOs may be able to more effectively manage performance, profitability and risk across the enterprise.”

In the past, CFOs may have been viewed by other c-suite leaders and board members as mere “bean counters,” but Carter highlights the increasingly strategic role of the CFO as a business partner, “helping to manage the business through the lens of finance and analysis.” The ability to present a narrative is foundational to remaining a relevant CFO at the forefront of their trade.

The Role of Data in Value Creation

Carter points to the growing role of dashboards in business. “Data is an enabler of growth. It’s a tool.” When dashboards are in place, business leaders have the visibility to make real-time changes and move the needle to drive growth. In addition, dashboards bring shared visibility for each role into the key metrics they’re accountable to deliver, creating stronger employee engagement and reducing the burden on the executive team to carry the value creation plan solely on their shoulders.

If you’d like to contact Carter Freeman, he can be reached at cfreeman@vcfo.com. Read more about VCFO at https://www.vcfo.com/.

If you’d like to explore how Blue Margin’s team can help you use data visibility to accelerate progress, contact us below!