In this Expert Insights Series interview, Jon Thompson speaks with Kison Patel, Founder and CEO of M&A Science and DealRoom. M&A Science is a community of practitioners focused on improving how deals get done, known for its virtual roundtables, annual summits, and a podcast followed by more than 50,000 M&A professionals.

DealRoom, part of the M&A Science ecosystem, is a purpose-built M&A lifecycle management platform designed to bring structure, visibility, and repeatability to complex transactions. Combined with the M&A Science Academy, it equips deal teams with tools, training, and frameworks to execute more effectively.

Kison’s work in M&A began in 2011 with the creation of DealRoom. He is also the author of Agile M&A, which outlines a disciplined, iterative approach to deal execution and integration. Prior to founding M&A Science, Kison served as a partner at Transatlantic Investment and Advisory and was a member of the Forbes Technology Council.

Jump to a section:

- Taking a Scientific Approach to M&A

- M&A Data Insights and Performance Metrics

- Command Rooms and Virtual Data Rooms

- AI in M&A: Looking Ahead

Taking a Scientific Approach to M&A

While M&A will always involve judgment, negotiation, and experience, Kison believes the industry relies too heavily on intuition alone. He argues that many of the hard-earned lessons from past deals can—and should—be systematized.

By identifying repeatable patterns, key metrics, and delivery milestones, deal teams can reduce risk and improve outcomes without eliminating the “art” of M&A. The goal isn’t to replace experience, but to support it with a framework that improves consistency and execution.

“When you buy a company, you think you know it—but you really don’t. You can get all the way to LOI without understanding how the business truly operates. If you take an agile, iterative approach—with clear deliverables for diligence and integration—you can get far better results.”

This mindset shifts M&A from a one-off event to a repeatable operating discipline.

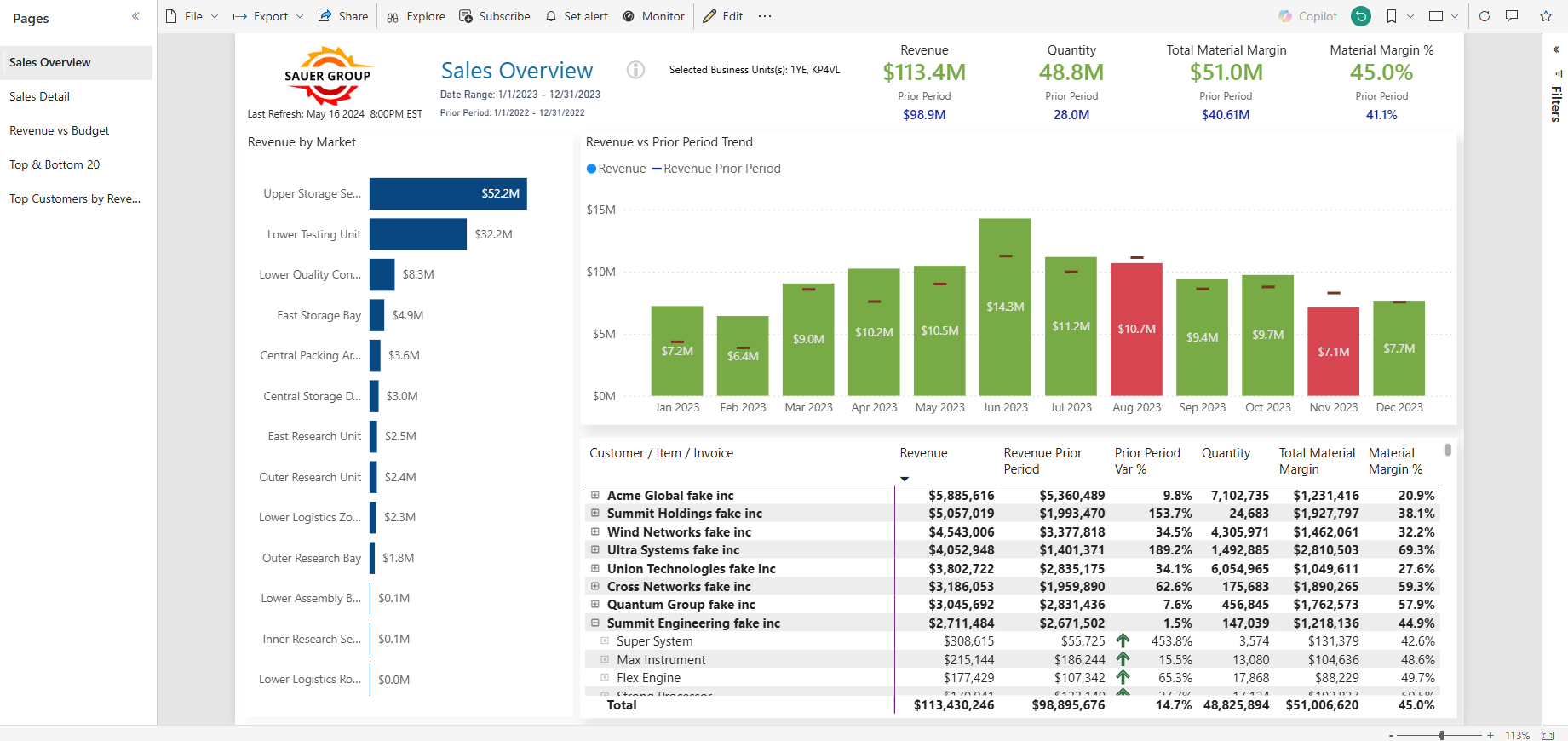

M&A Data Insights and Performance Metrics

“When data is hard to access, it starts to sour the relationship. The more transparency you have, the faster you can get comfortable with a deal.” – Kison Patel

High-quality, well-organized data plays a critical role in deal velocity and valuation. Clean, comprehensive data enables faster diligence, stronger narratives, and better alignment between buyers and sellers.

Real-time data visibility allows deal teams to track performance metrics throughout the lifecycle—from target evaluation through post-close integration. These metrics help identify risks early, monitor progress, and ensure execution stays aligned with strategic objectives.

Post-close, data becomes even more important. It provides a shared view of performance, helps management track synergy realization, and supports operational alignment across systems, teams, and processes.

Command Rooms and Virtual Data Rooms

“You need a single source of truth designed specifically for running an M&A process. Emailing Excel trackers back and forth is an outdated and inefficient way to operate.” – Kison Patel

Modern M&A execution requires a centralized command room—a system purpose-built to manage diligence, integration planning, and execution. Platforms like DealRoom provide that foundation by bringing data, tasks, and stakeholders into one environment.

Virtual data rooms and modern analytics platforms further support this shift, replacing fragmented workflows with secure, collaborative, and auditable systems. Together, these tools reduce friction, improve transparency, and accelerate decision-making.

Artificial Intelligence in M&A: Looking Ahead

“Step one is getting people off Excel. Step two is AI. There’s a real lag before advanced technology takes hold in M&A.” – Kison Patel

Kison and Jon discussed why AI adoption in M&A is likely to trail other industries by several years. The challenge isn’t enthusiasm—it’s trust, data quality, and the controlled environments required for sensitive deal information.

Near-term applications may include automating summaries, templating diligence outputs, and improving internal workflows. Broader AI-driven disruption will depend on organizations first establishing clean, well-governed data foundations.

Connect with Kison and M&A Science

Learn more at mascience.com, listen to the M&A Science Podcast, or connect with Kison on LinkedIn.

About Blue Margin

Blue Margin increases enterprise value for private equity–backed, mid-market companies by serving as their fractional data team. We advise on, build, and manage modern data platforms that improve visibility, execution, and outcomes.

Our approach—proven across 300+ companies—expands multiples through data-driven execution, as outlined in our book The Dashboard Effect. Download your copy or get weekly insights on our podcast.