Article summary: Discover how data helps solve the manager vs mentor tug-of-war in private equity.

Topic: Private Equity Data Intelligence

Assoc. Keyphrase: Portco Management

Every year in October, the “World’s Biggest Tug-of-War” takes place in Okinawa, Japan.

The entire downtown of Okinawa’s capitol city, Naha, is flooded by crowds of more than 250,000 people. There’s dancing and parades, exotic foods and snake wine—and a giant rope weighing 40 metric tons that stretches sea-serpent style down Naha’s highway 58. When all is said and done, one team earns a victory, fans snip of pieces of the rope for souvenirs, and both sides join together in a celebration that lasts well into the night.

Though not as festive nor as well-known, another tug-of-war takes place each day in the offices of America’s private equity (PE) firms. General partners (GPs) overseeing a sponsored company’s executive team are pulled in two directions. It's a precarious competition of two personalities: that of mentor, and that of manager. Letting either side win is the reason many investments fail.

Sometimes it seems like there’s no way the two could live in harmony together. But that's not at all the case.

Visibility into KPis

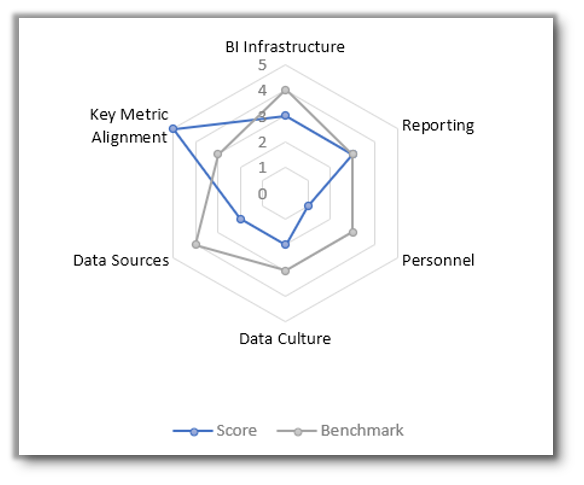

It’s a very simple and common problem: Data is among a company’s most valuable assets, and many companies fail to put it to good use. Creating an automated data intelligence system that gives real-time visibility into key business performance metrics is the key to accomplishing both goals—with one dashboard.

There's no better way to empower your portco executive team than to give them clear visibility into the platform of metrics upon which their company's success stands. And there's no better way to avoid slipping into micro-management than having clear visibility into the key metrics yourself.

Nothing triggers micro-management more quickly than poor visibility into performance. The ability to maintain transparency is table stakes for successful executives. Obfuscation has never been part of a successful executive’s plan.

“If you want to motivate employees, stop following your instincts and adopt a data-driven approach.” — Harvard Business Review

Even further, if you don’t have clarity into how a portfolio company is performing, you are going to push your executive team to get you the numbers you need to assess performance. What’s more cliché than an executive team complaining that they spend too much time preparing reports for their board?

The pressure of overdone reporting causes competent executives to simply feel untrusted. The result is actually the opposite of the goal. It robs the team of the little time they have (outside of operating the business) to develop and implement larger strategic initiatives that will move the company forward.

The Great Differentiator for PE Firms

Every GP must face questions like:

- “What makes your PE firm different from the others?”

- “Beyond buying smart, why should investors put their funds with you instead of your competition?”

- “Why should my platform company take your buyout offer over others?”

There are 6,000 firms in the US listed as “PE/Buyout” in Pitchbook, each claiming to have the best team and the best model. Since portco success depends on giving management teams the tools they need to put their experience to good use, PE deal teams must differentiate themselves and their impact on portco success. How?

The answer is shared visibility into company performance metrics.

If there's something in the data that you want to hide, then you've already lost. The right management team has nothing to hide, even when risks arise and performance falls short.

In a competitive, “tug-of-war” atmosphere, it becomes increasingly imperative for GPs to employ proven key differentiators that will truly set them apart from the other players. Creating alignment between investors and key executive team members will drive forward PE success on a platform of trust, transparency, and empowerment.

Three Key Thoughts:

“General partners (GPs) overseeing a sponsored company’s executive team are pulled in two directions… that of mentor, and that of manager.”

“Nothing triggers micro-management more quickly than poor visibility into performance.”

“In a competitive, “tug-of-war” atmosphere, it becomes increasingly imperative for GPs to possess proven key differentiators that will truly set them apart from the other players.”

For Further Reading:

Sources:

- Chris Willson Photography. 2019. “World's Biggest Tug of War - Okinawa, Japan.” Feb 24, 2019. YouTube video. 3:54. https://www.youtube.com/watch?v=4S3j5-_ZBak

- Emily Dickson, “Flex Your Muscles at Okinawa's Great Tug-of-War.” Japan Cheapo. February 26th, 2020. https://japancheapo.com/entertainment/naha-tug-of-war-festival/

- Tomas Chamorro-Premuzic and Lewis Garrad, “If You Want to Motivate Employees, Stop Trusting Your Instincts.” Harvard Business Review. February 08, 2017. https://hbr.org/2017/02/if-you-want-to-motivate-employees-stop-trusting-your-instincts