Private Equity investors make investment decisions based on balance sheets and P&L statements – typically in Excel, the tried-and-true tool of choice. Yet most firms struggle to keep up with running the real-time reporting race needed to move companies forward, post-acquisition.

Portfolio companies are often saddled with multiple ERP systems and fragmented financial and operational data. Too many reports originate from too many disparate sources, and there’s too little time to separate signal from noise.

Cloud-based data analytics technologies, such as Power BI, are transforming the M&A lifecycle, and private equity investors are taking note. In the cut-throat middle market, investors need the ability to access near real-time data across portfolio companies, to accurately address and overcome barriers to growth.

It’s little wonder “agile analytics” was listed by Cohn Reznick as a top priority for private equity investors in their 2017 Middle Market Private Equity Outlook report. According to the report:

“Not only can a robust data analytics program help PE firms drive competitive advantage, it can help them make quicker and better go or no-go decisions for potential acquisitions, uncover profit generating opportunities within portfolio companies, accelerate the due diligence process, and examine market trends that may influence a profitable exit strategy.”

According to EY Capital Insights most recent Global Corporate Divestment Study:

“46% of PE executives say that availability of sufficient granular data was the most important factor in staying in an acquisition process. Forty-four percent indicate that a lack of confidence in information is the most significant factor that causes a PE firm to reduce its offer or walk away from a deal. The survey also found that 49% believe access to meaningful data is the biggest portfolio review challenge.”

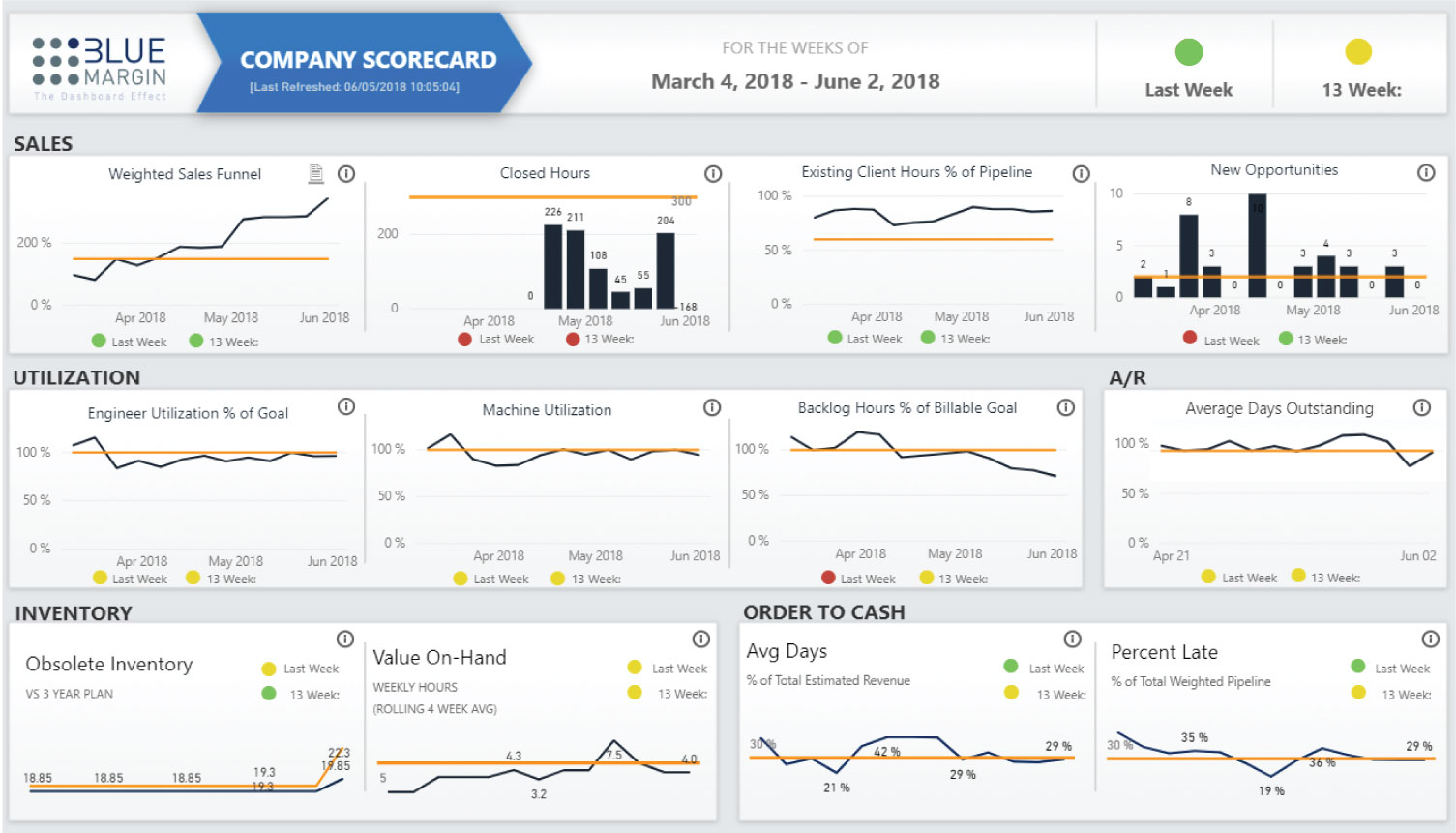

Data-driven dashboards allow investors to more effectively manage their portfolio companies, and having ready access to key performance data maximizes the perceived value of a company at exit. Another advantage? All stakeholders - from investors, to limited partners, to executive teams and line-operators - have access to the same data, creating transparency and shared accountability throughout the chain of command.

In organizations normally beleaguered by non-integration, transparency causes individuals to take more ownership of their responsibilities and maintain focus on the right priorities. Transparency drives progress from the bottom up instead of just from the top down.

A private equity firm's goal is to zero-in on the metrics that most impact a company’s value and potential, empowering portcos to address issues quickly. By embracing indsutry-leading business intelligence tools, investors can graduate from slow-moving Excel analysis to real-time reporting that translates into growth.

If you are interested in learning how data analytics and dashboards can lead your company into the digital transformation era and upgrade investment lifecycle, please get in touch with us. We'd love to help.

For Further Reading:

Power BI Dashboard Case Studies for Private Equity Companies: See how Private Equity uses data intelligence and Power BI dashboards to drive performance and profit.

Private Equity Turns to Business Intelligence to Maximize Investments: Private Equity is turning to data intelligence to maximize investments. See how.

How To Implement Portfolio Analytics To Manage Your PE Portfolio: Learn four steps portfolio companies can take to immediately shape strategy and improve outcomes using the data they already have.

Private Equity Advantage: Data Intelligence Strategies You Can Steal - Learn the data optimization strategies PE firms can use to differentiate themselves through digital transformation.